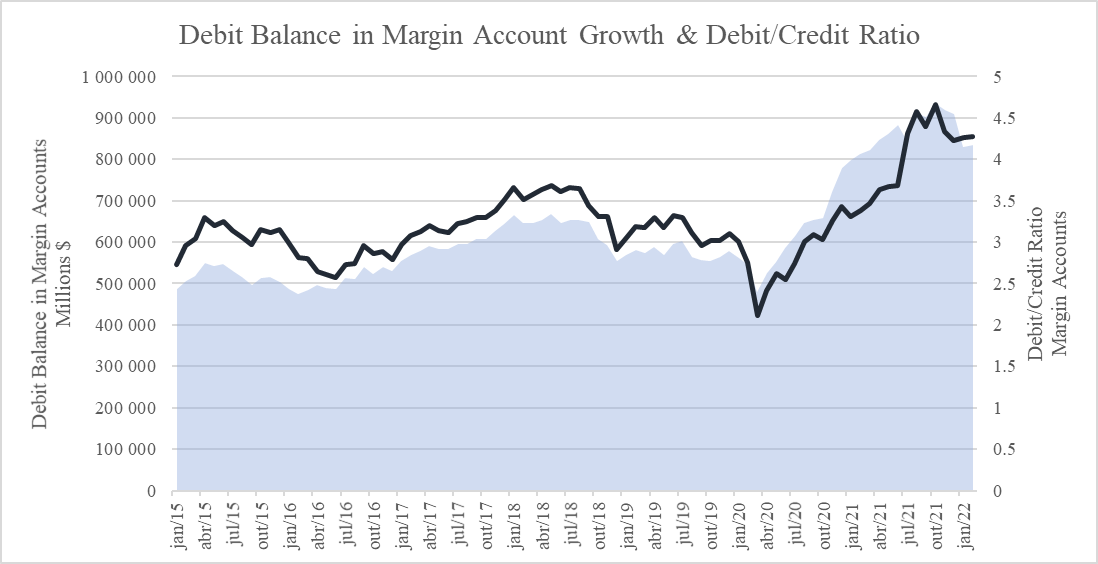

In today’s world, of extremely low interest rates across the board, the amount of leverage in the system has been increasing substantially. As expected, Investors & Speculators have been using low interest rate debt in order to increase returns and leverage their investments - as we can see below, debit balances in margin accounts are close to a record high - peaking around 900 Bln $ in 2022 - with debit to credit ratios hitting ~4.6x.

Consequently, there is an increasing sensitivity to interest rate changes in the system and as previously studied, the simultaneous unwinding of leveraged positions can trigger financial market turbulence.

However, looking at outstanding margin loans does not paint the full picture regarding the amount of leverage in financial markets. Although balance-sheet measures of leverage are available, it is useful to take into consideration measures of leverage that incorporates both on- and off-balance-sheet activities.

Since the introduction of the Dodd–Frank Wall Street Reform and Consumer Protection Act in July 2010, a significant portion of derivative contracts that were being traded in the OTC markets moved to exchanges and thus enhancing the process of price discovery and ensuring the optimal level of margining and collateral exchange by market participants significantly reducing the chances of counterparties building up large uncollateralized losses.

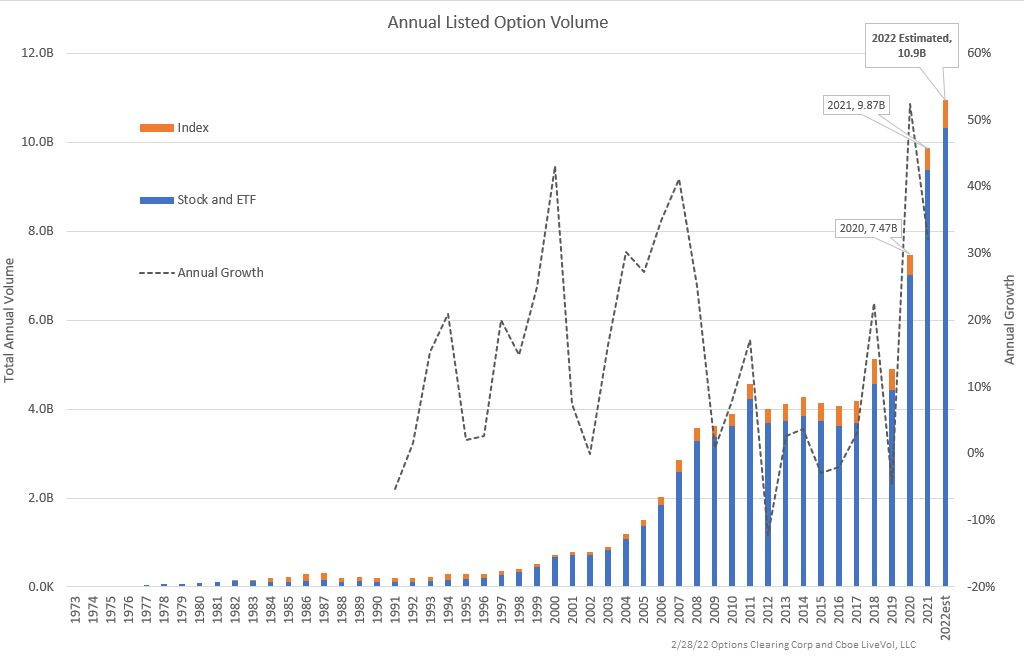

With the commoditization of standardized derivatives such as Options and Futures, retail adoption of derivatives trading skyrocketed after 2018 on the heels of brokers like Robinhood - introducing, among other things, free trading, easy sign ups, easy access to options, referrals and a simplified UI.

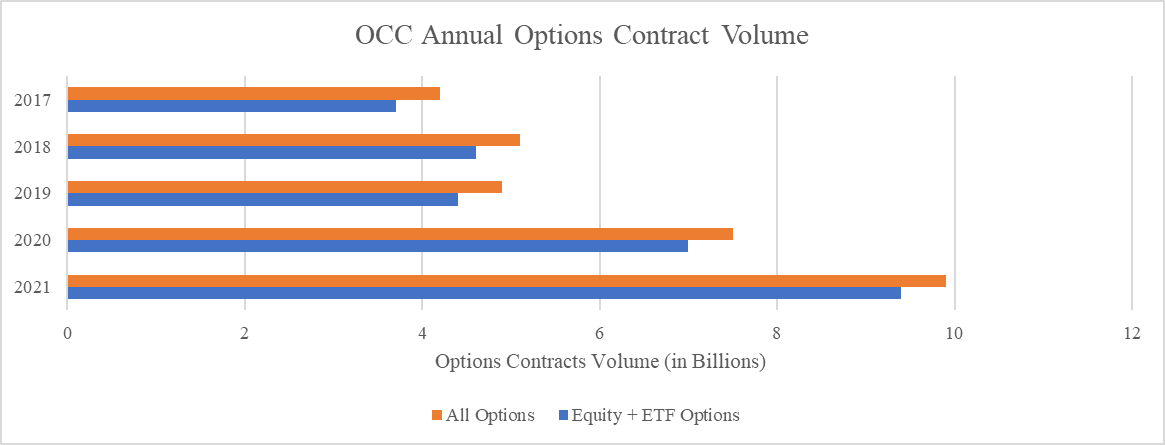

Since then, several brokers and exchanges have been reporting substantial growth in Options ADV. The OCC has also been reporting several records of Option Volume and Open Interest over the last couple of years. This year the US options market is already off to a strong start with an average daily volume near 43.4 million contracts, suggesting that a total near 11B contracts may be achieved this year, after record-breaking performance in 2021 and 2020.