In the Part 1 of “Why Unusual Activity Matters” we wrote about the increasing amount of leverage in the system - on- and off-balance sheet leverage. In particularly we focused on the recent meteoric growth of Options Trading.

In this post we will go back to 1973 - The year where Fischer Black and Myron Scholes finally published an article titled "The Pricing of Options and Corporate Liabilities". That same year Chicago Board Options Exchange (Cboe) is founded and becomes the first marketplace for trading listed options.

In 1977, due to the explosive growth of the options market, the SEC decided to conduct a complete review of the structure and regulatory practices of all option exchanges - this studied was called the “Special Study of the Options Markets” and published in late 1978.

The study pointed out several abuses by market participants - and the lack of resources to monitor complex trades. Additionally, the SEC also pointed out a type of behavior that was at the time classified as “mini-manipulation”.

“Affecting stock transactions to depress or prevent a rise in the price of a stock in order to prevent near the money, at-the-money, or slightly in the money call options from being exercised, and to protect a previously received premium, is referred to as capping.

Similarly, affecting stock transactions to prevent a decline in the price of a stock, in order to assure that put options written on the stock will not be exercised and that premiums previously received will be protected is referred to as pegging.”

“(…) These practices are most likely to occur just before expiration of the options series, when the probability of exercise is highest. Capping and pegging are forms of minimanipulation.”

Special Study of the Options Markets, SEC December 1978

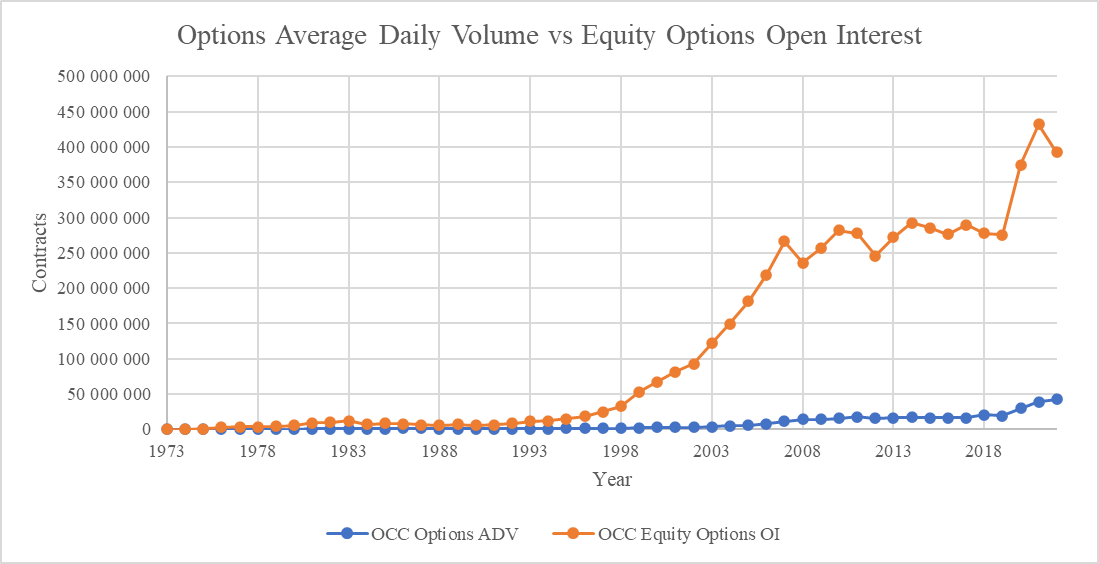

It is important to mention that, in relative terms, the options market grew ~6,640x in terms of contract ADV - from around 6,400 contracts in 1973 to 42.5 million in 2021. Recently, single-day total volume record was broken twice on two consecutive trading days: on Friday, January 21 2022 with 63.5 million contracts and Monday, January 24 2022 with 63.7 million contracts.